Supply Chain: Issues & Analysis: Tax and Transfer Pricing

1. Overview

Transfer pricing governs the pricing of transactions between related companies. It is therefore a key element in all intra-group transactions within the supply chain.

This means that any changes to the supply chain will need to take transfer pricing into account. However, this also gives rise to opportunities if properly managed.

Value chain optimisation involves the integration of tax (including transfer pricing) planning into commercially driven business and supply chain restructuring.

Functions, risks and assets allocation determines where profit (or losses) should arise in the supply chain. Shifting functions, risks and assets between jurisdictions as part of commercially driven supply chain restructurings can therefore have significant tax benefits.

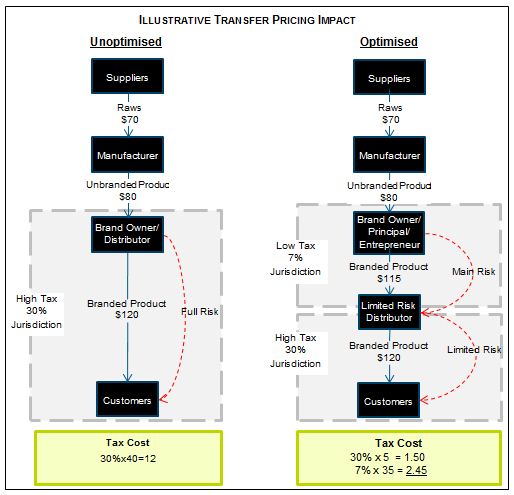

A very simplistic example is set out below.

In this example, optimised structure involves significant risk functions and the brand vesting in the Principal/Entrepreneur Company in a low tax jurisdiction. The role of the Brand Owner/Distributor itself is therefore limited to that of a Limited Risk Distributor. As a result, the Limited Risk Distributor (located in a higher tax jurisdiction) receives a lower profit ($5) with the bulk of the profit ($35) being retained by the Principal Company.

The Manufacturer will act as a toll or contract manufacturer, thereby performing services for the Principal Company on a cost-plus basis. It is also possible for group headquarters, the shared services and R&D functions to sit outside the Principal Company, at a cost-plus return.

Some jurisdictions have special "Principal Company" tax regimes providing low effective tax rates (eg Switzerland, Belgium, Ireland, Singapore and Hong Kong.) A Principal Company can potentially also be a Holding Company, making use of other favourable tax regimes also. A company which is a Principal Company and a Holding Company can sometimes be referred to as a "Mixed Company".

Click here for a more detailed example of how a Principal Company structure can work.

2. Related Issues

Where functions, risks and assets are shifted from one jurisdiction to another, there are tax issues other than transfer pricing which need to be considered. These are:

Potential exit charges

If assets (tangible or intangible) are transferred out of a jurisdiction, this can give rise to taxable gains in that jurisdiction. Clearly the more valuable the asset, the more risk in this respect.

Impact on the VAT/customs duties position

Any changes affecting the contractual arrangements and/or flows of the goods/services are likely to have indirect tax consequences. For example, re-characterising the functionality of an entity can change its VAT status and changes in intra-group pricing of goods/services can lead to changes in duties.

Impact on any relevant "Controlled Foreign Company" or CFC analysis

Controlled Foreign Company (or CFC) rules enable jurisdictions to tax certain profits of subsidiaries even if they have not been distributed to that jurisdiction. Each jurisdiction will have different rules in this respect but the sorts of profits which might be caught are profits from:

- Passive sources such as intellectual property (IP);

- Related party transactions in goods where the goods are produced and used outside the relevant jurisdiction;

- Related party transactions in services where the services are performed outside the relevant jurisdiction; and

- Profits from non-operating or insubstantial businesses.

3. Road map

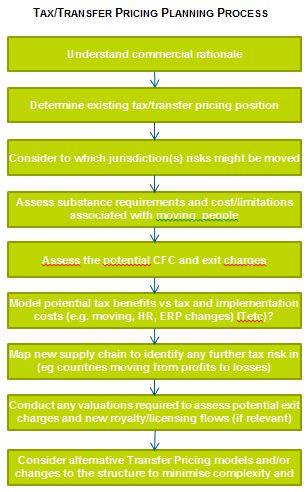

Given the potential impact of tax and transfer pricing issues, it is important that they are analysed as an integral part of any proposed changes to the Supply Chain.

Key issues include:

Moving which functions?

In determining which functions to move to another jurisdiction, there are a number of factors to consider. As the road map indicates, commercial and tax issues need to be considered alongside each other.

Routine functions are usually more easily moved to another jurisdiction and are less likely to trigger exit charges. However, in the majority of cases it is non-routine functions that businesses seek to transfer in the context of TESCM arrangements.

When non-routine functions are shifted within the supply chain, the entities previously holding the relevant function, risk and/or assets will typically end up with a more routine functionality and, therefore, a smaller profit.

IP

When considering IP in the supply chain planning, the valuation of these items is crucial as it determines the potential exit charge, but also the basis for the new royalty/licensing arrangements for the group.

Although, in general, most jurisdictions follow the OECD principles there are several differences in how tax authorities look at the value of IP (eg the IRS guidance tends to allocate a perpetual life to most IP unlike some of the European tax authorities). Therefore, it is important to carefully consider the IP value from the perspectives of both jurisdictions (ie the original owner and the new owner of the IP).

Substance

Different jurisdictions also apply different requirements for substance. In other words, different jurisdictions apply different tests as to the functionality and risks that are required to be moved to a jurisdiction in order for a business to shift profits to that jurisdiction. In the case of IP, it may also be that the management of the IP as well as the ownership needs to move.

Under the new OECD guidance the concept of Significant People Function or SPF is used to further explain how functionality and risk need to be linked to the people that carry out those functions or take the risk. For example, for the IP to be owned in a certain jurisdiction the pure funding and/or legal ownership is not sufficient to attract the totality of the IP value (and profit). The people driving the IP creation, maintenance and enhancements need to be in the same jurisdiction else the legal ownership is more likely to only attract a return on the investment.

Another important consideration when altering the supply chain structure is that as a result of moving certain functions and/or risks the new intra-group transactions can become more difficult to price using standard benchmarks. The business should therefore carefully consider the options for the new Transfer Pricing policies and look at alternative models such as residual profit split models (RPSM) especially when the functional and risk allocation is shared amongst a number of legal entities in different jurisdictions.

4. Information required for tax and transfer pricing review

This list summarises the typical information and data usually necessary to consider all tax and Transfer Pricing risk when looking to implement a more tax efficient supply chain.